What is a Counter Check: A Beginner’s Guide

Advertisement

Triston Martin

Dec 02, 2023

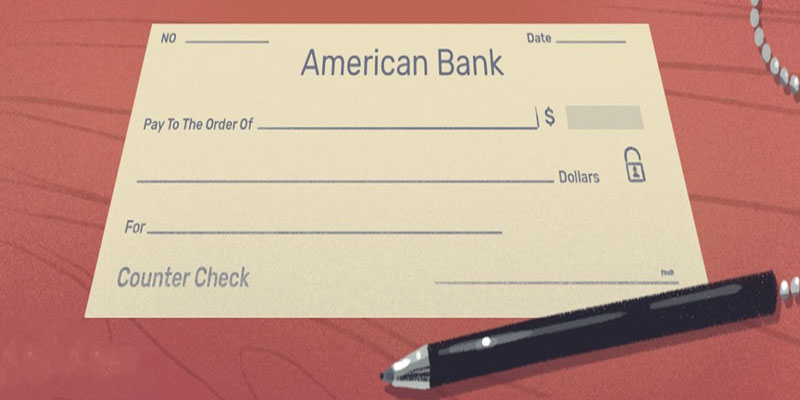

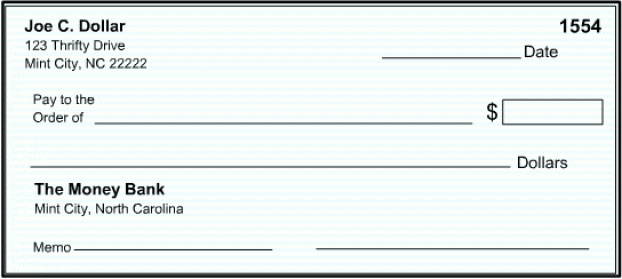

People always think what is a counter check So, a counter check is a check that is usually kept at the cashier's desk (counter). It is filled out and given to a person who wants to get their money. In most cases, these checks come in simple forms. They don't have all the complicated security protocols that personal and corporate checks have because they'll be received by an approved bank representative in the account holder's home or office.

People also use the term "counter check" to refer to individual checks printed by the teller with all of the customer's account information, which can be used as a routine visit if the customer runs out of checks or loses his checkbook. Sometimes, counter checks need to be paid for by their owners because it isn't a service often used.

How to Get Counter Checks

Visit the branch of your local bank check and ask for a counter check. You can also call them. First, call and see if there are counter checks at the branch. Find out the process and if you need to use a branch. Even though you can only use an online bank to get counter checks, there is no branch to visit, so you can't get checks back.

Once you're at the branch, ask the bank employee or individual banker to photocopy the checks, show one's ID, and do any other steps the bank asks. In a few minutes, you should be able to hold your inspections in your hand.

Counter Checks Are Not Cashier's Checks

Counter checks aren't the same as cashier's checks, which are checks that your bank can print for you when you want. Cashier's checks are for "cleared" or "guaranteed" funds, and they have the name and address of the person they're for printed on them. To make a payment, five counter checks aren't safe enough.

If you don't want your recipient to know your bank account number, you can use a cashier's check. It doesn't show your account on the check. Cashier's checks can also be a safe way to pay even if you don't have a bank account.

How to Use Fewer Checks

Sign up for automatic payments through ACH for utility bills and insurance rates every month.

Use your bank's internet payment system to pay your debts now. A fewer check will be sent to your bank, so you don't have to.

Your debit card can use to pay for things instead of writing a check at a store. Use a card and pay it off each month to build good credit. It will help you get good credit.

To pay back your friends, you can use internet services and apps that allow you to send money, like Venmo.

Pros

- Getting a counter-check is the best thing about it. You can get what you need quickly by going to the branch. Instead of waiting for a package of checks to arrive in the mail, you can begin writing inspections right away.

Cons

- To be safe, be aware that some businesses don't always need to accept counter inspections as payment. It doesn't matter if the bank prints your name and address on the check. Counter checks don't usually have a check number, making it clear to sellers that the check is a counter check. Merchants might think that you've just opened a new account, which means more risk for them, or that you're using a fake check that isn't very good.

- To print checks at the bank, you'll usually pay a small fee, like $1 or $2 for each one. It's also not going to happen that you walk out now with 50 checks.

Conclusion

The counter-check is a type of verification that doesn't have the account holder's name, the address, or the account number on it, but it does. Counter checks are used when people run out of imprinted checks or before they print the new account.

Banks give out this to people who haven't yet gotten pre-printed checks from their bank.

In most cases, these checks come in simple forms. They don't have all the complicated security protocols that personal or organizational checks have. They will be earned by an authorized bank representative in the account holder's home or office.